| |

Refinancing was not an option more many people stuck in underwater loans until the HARP refinance was re-released by lenders with the 2.0. The HARP mortgage was revamped with pressure from the Obama Administration last month. The Home Affordable Refinance Program has been around for years, but the government added some security and incentives to encourage more mortgage lenders to participate in the program. If you haven't had more than one late mortgage payment in the last year, there is a good chance you may qualify for the HARP mortgage. Since Obama announced his support for the revised relief program, our HARP mortgage lenders have committed to competitive rates and quick closings.

Would refinancing help you keep your home? The HARP refinance program opens the door for many borrowers who were previously turned down in their attempt to refinance. If you have an adjustable interest rate or a loan with rate over 4%, this may be the path you need to go down to save money. Let our team help determine if you qualify for a HARP mortgage refinance.

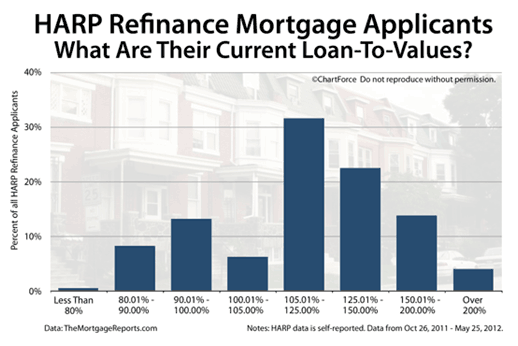

Initially the HARP mortgage program had little success because it failed to meet regulators' expectations when it was launched in Spring of 2009. One of the problems originally was that homeowners who were significantly underwater could not refinance with HARP because of the maximum 125% loan to value restrictions. The new HARP mortgage program does not have loan to value restrictions so many of these borrowers will have an option to refinance. To see if you meet the HARP mortgage 2.0 requirements check out this recent article, Underwater Mortgage Refinance.

The FHFA said they provide revised guidelines to mortgage lenders soon.

No appraisal will be required if Fannie Mae or and Freddie Mac have enough data in their automated valuation system. Lending fees will be eliminated for borrowers who refinance their mortgages into a shorter-term loan such as a 20-year mortgage or a 15-year mortgage.

The HARP mortgage program, which had been scheduled to expire in June 2012, has been extended through the end of 2013.

- Government refinancing emerges with a fresh new HARP Mortgage.

- The Government promises to relieve banks of liabilities on existing mortgages that encourages more lenders to get involved.

- Not all applicants will qualify for HARP mortgages.

HARP in the News: In a recent Forbes article, they reported that, “The Center for Responsible Lending released their findings confirming that “the rate of loan defaults and foreclosures are consistently worse for homeowners that received alternative programs, like the HARP mortgage.” The report indicated that borrowers that were approved for high LTV loans before the market crashed were much more likely to default. The Center for Responsible Lending reaffirmed that "default rates were higher in neighborhoods that had the most significant amount of underwater loans performed.

Did you know that the HARP 2.0-expires December 31, 2013? Unless Congress passes a new bill or Obama writes an executive order, the HARP mortgage program will no longer be available January 1, 2014. There has been increased discussion regarding the HARP 3.0 but specific changes are largely unknown. Many insiders believe that Obama will expand HARP 3.0 to cover people who have underwater mortgages that are not presently owned by Fannie Mae or Freddie Mac. Learn more about refinancing with HARP 3.0. |